[ad_1]

The underneath is a immediate excerpt of Marty’s Bent Issue #1222: “The Fed is formally terrified of bitcoin (or quietly trying to endorse it)” Signal up for the newsletter below.

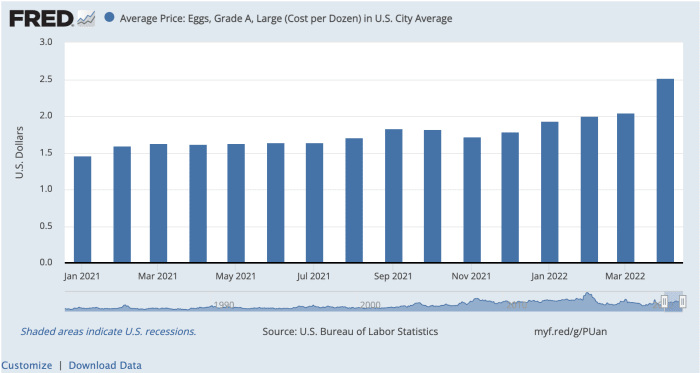

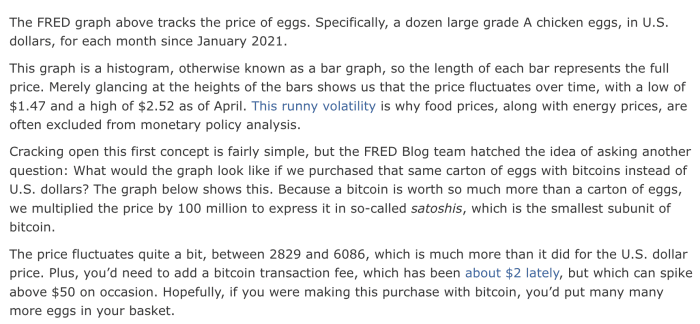

The comedians about at the St. Louis Federal Reserve dropped a blog site write-up earlier nowadays that compared the fluctuation of eggs price ranges in U.S. pounds and sats from the commencing of 2021 by way of April 2022. It looks like an try to dunk on bitcoin, but if you glimpse intently at the charts you can expect to see that the total inflation level of eggs more than the cherry-picked timeframe is lower in sats (44.3%) than it is in dollars (71.9%). Positive, bitcoin’s value did fluctuate extra swiftly about the timeframe, but if the Fed is heading to cherry pick details, we right here at TFTC are heading to do so as effectively to establish why this isn’t really the most accurate representation of the circumstance.

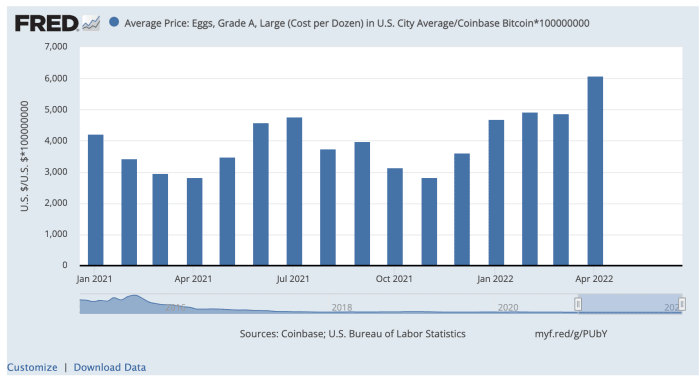

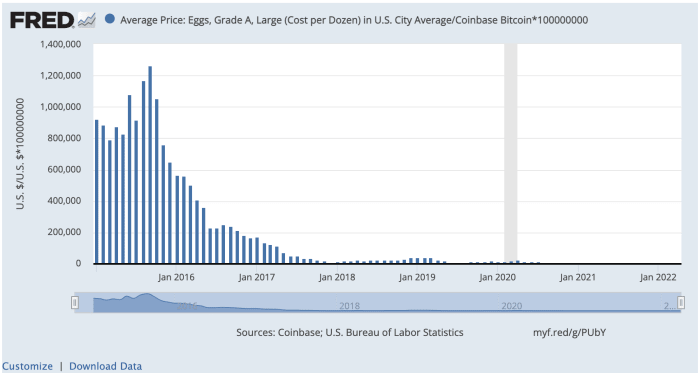

If the Fed were being to be a lot more honest — and get their heads out of the gutter of small-termism — they would share what they shared higher than, but also zoom out a little bit (as is manufactured feasible on the pretty web page of the tried dunk) to give their visitors a extra precise depiction of the deflationary tendencies of bitcoin around extended intervals of time and evaluate it to the U.S. dollar. Considering the fact that they were unwilling to do it in their blog post, we will share that info with you in our rag these days.

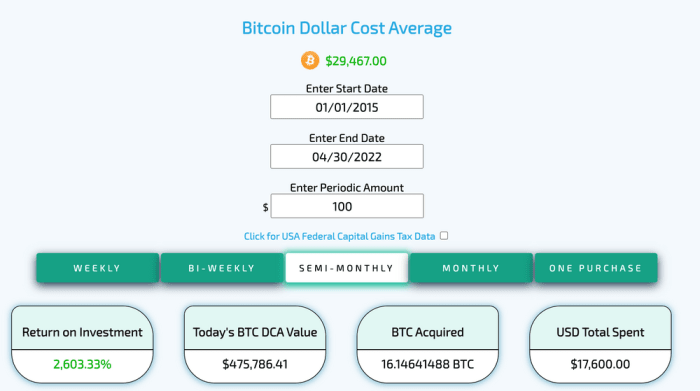

As you can see by zooming out, the rate of eggs as calculated in sats fell by — *checks notes* — 99.3% considering the fact that January 2015 (when the Fed began tracking bitcoin knowledge), when growing by 19.2% in U.S. pounds. Guaranteed there was some volatility together the way, but above the training course of 76 months an individual’s purchasing energy amplified considerably if they ended up holding bitcoin. To visualize this increase in buying electrical power yet another way, this is what it would look like if an unique had been to consider $100 for each paycheck considering the fact that the commencing of 2015 to preserve in bitcoin.

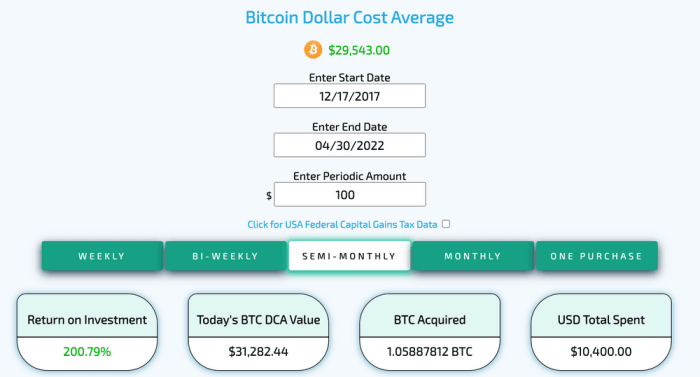

Converse about excellent financial savings technological know-how! And for those of you skeptics out there seething simply because bitcoin was investing at $250 in the vicinity of that cycle’s bear marketplace lows on January 1st, 2015, here’s what it would glance like if you began conserving $100 value of sats for each paycheck commencing at the bull sector top rated of late 2017.

However a pretty extraordinary exhibit from the remarkable cost savings technology.

A little bit odd that the teachers performing at the St. Louis Fed office would endeavor to score dunking details on bitcoin in this fashion. It’s possible it truly is a small-key veiled endorsement of the upcoming reserve currency of the entire world. A refined signal that men and women should start off looking at bitcoin as their monetary fantastic of choice. Is the St. Louis Fed breaking ranks and performing as a fifth column actor attempting to undermine the dollar’s position from within just?! Nothing would surprise your Uncle Marty at this level. It would be incredibly admirable if this is the scenario.

[ad_2]

Resource hyperlink